The concept of cash laundering is very important to be understood for those working within the financial sector. It's a process by which dirty money is transformed into clear cash. The sources of the money in precise are criminal and the money is invested in a manner that makes it appear like clean money and conceal the identification of the prison part of the money earned.

Whereas executing the financial transactions and establishing relationship with the brand new clients or maintaining existing clients the obligation of adopting ample measures lie on each one who is a part of the group. The identification of such element to start with is simple to deal with as a substitute realizing and encountering such conditions later on within the transaction stage. The central financial institution in any country provides full guides to AML and CFT to combat such activities. These polices when adopted and exercised by banks religiously present sufficient safety to the banks to deter such conditions.

Its economy is dependent on tourism and financial services. Know their customers and their expected patterns of transactions.

Bvi International Private And Offshore Banks

Law of the British Virgin Islands ûBVI as it pertains to anti-money laundering measures.

British virgin islands money laundering risk. On 3 March 2020 the BVI Financial Services Commission BVI FSC posted commentary on its website regarding two statements made by the Financial Action Task Force FATF on 21 February 2020 on anti-money laundering and terrorist financing considerations regarding. 11 This is the British Virgin Islands first money laundering and terrorist financing national risk assessment NRA. With the British Virgin Islands - albeit reluctantly - on board all of the UKs overseas jurisdictions have now declared their intent to implement public beneficial ownership registers.

The report presents the findings of sectoral assessments for the period 2015 to 2019 and is a follow-up to the countrys 2016 National Risk Assessment report. Banks are generally required to do three things to combat laundering. The British Virgin Islands has adopted an all crimes approach to predicate offences under its AML and terrorist financing regime although foreign crimes which are not crimes in the British.

Monitor transactions and examine those that seem atypical. Doing so could significantly cut down on money laundering though it would also raise questions about privacy that would need to be addressed. On 13 February 2019 the EU Commission adopted a new list of 23 third countries that had been identified as having strategic deficiencies in their anti-money laundering and counter-terrorist financing frameworks as defined under the Fourth and Fifth Anti-Money Laundering Directives.

The British Virgin Islands Financial Services Commission BVIFSC has published its Money Laundering Risk Assessment 2020 report on December 10 th 2020. The British Virgin Islands BVI is a UK overseas territory. The British Virgin Islands Financial Services Commission BVIFSC has published its Money Laundering Risk Assessment 2020 report on December 10 th 2020.

It is not intended to be exhaustive but merely to provide brief details and information which we hope will be of use to. It deals in broad terms with the requirements of BVI law. The Financial Investigation Agency Act 2003 came into force on 1 April 2004.

Under the UKs Money Laundering Regulations regulation 331b enhanced due diligence EDD is mandated for any business relationship with a person established in a high-risk third countryUntil the end of the Brexit transition period the list of high-risk countries was determined by the European Union EU under the 4th Anti Money Laundering Directive. The Financial Investigation Agency FIA is the designated national Financial Intelligence Unit FIU for the British Virgin Islands BVI. Anti-money laundering background overview of country risks The British Virgin Islands is a leading international financial centre with a robust anti-money laundering regulatory structure.

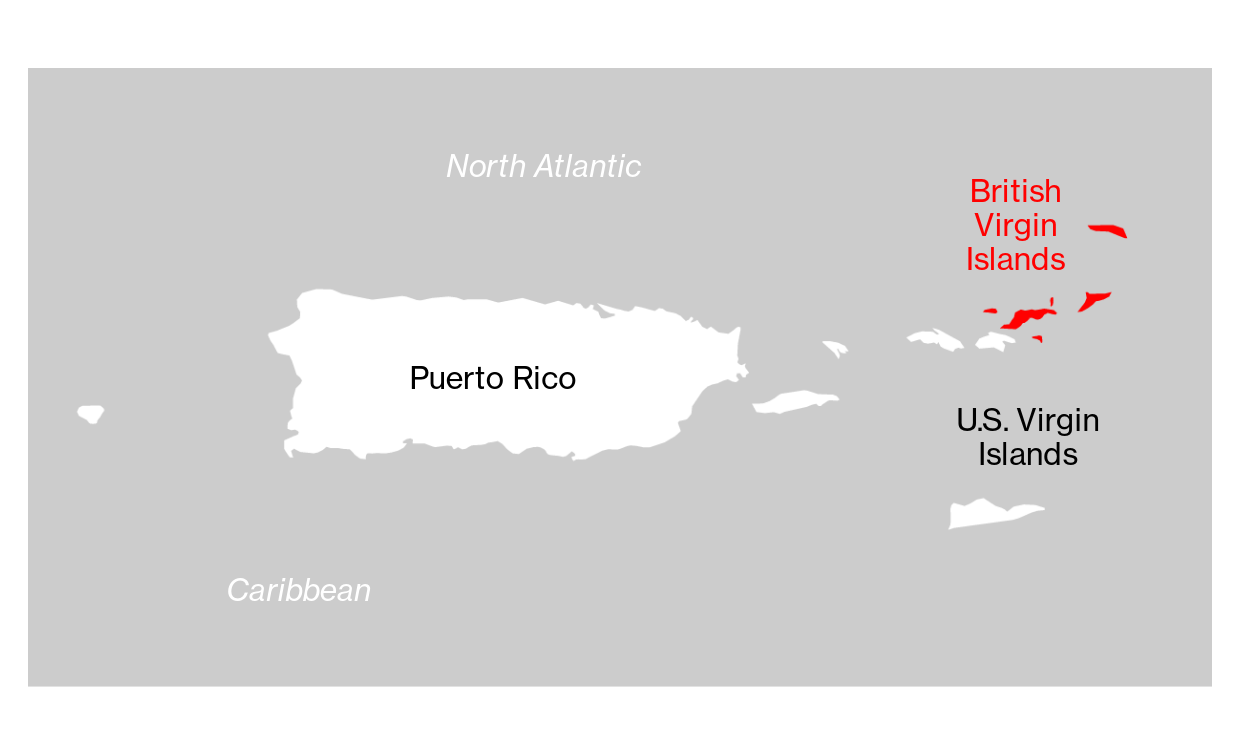

The British Virgin Islands is a member of the Carribbean Financial Action Task Force CFATF. The British Virgin Islands is a member of the Carribbean Financial Action Task Force CFATF. The US Virgin Islands has been included on this list.

British Virgin Islands is categorised by the US State Department as a CountryJurisdiction of Primary Concern in respect of Money Laundering and Financial Crimes. And e take into account without limiting paragraph d the greater risk of money laundering. In general terms money laundering covers all activities relating to the proceeds of criminal conduct.

Terrorism financing is not expressly defined in the British Virgin Islands. It aims to help the Virgin Islands understand the effectiveness of its measures and systems for anti-money laundering AML and combatting the financing of terrorism CFT across Government supervisory and. If these are fully implemented without further delay money launderers and the corrupt will soon find it more difficult to hide and then enjoy their dirty money.

The Act established the British Virgin Islands Financial Investigation Agency as an autonomous law enforcement agency generally responsible for the investigation of white collar. Countries subject to its Call for Action programme currently the highest risk. And report suspect behavior to the government.

Terrorist Financing Risk Assessment Report - 2020 Money Laundering Risk Assessment Report - 2020 Risk Assessments British Virgin Islands Financial Services Commission Skip to Navigation. The British Virgin Islands anti-money laundering legislation has been carefully crafted and diligently upgraded to ensure that the jurisdiction remains in compliance with the highest of international standards. Person of the risk that any business relationship or one-off transaction may involve money laundering and shall be appropriate to the circumstances having regard to the degree of risk assessed.

The report presents the findings of sectoral assessments for the period 2015 to 2019 and is a follow-up to the countrys 2016 National Risk Assessment report.

Top 10 Benefits Of British Virgin Islands Offshore Banking Business Setup Worldwide

British Virgin Islands Suffers Amid Push Against Money Laundering Financial Times

British Virgin Islands To Unmask Company Owners By Breaking London Daily

British Virgin Islands Wiki Thereaderwiki

The British Virgin Islands Grudgingly Joins The Fight Against Money Laundering Transparency International Uk

Asian Logging Companies Use British Islands For Tax Dodging British Virgin Islands The Guardian

The Bvi S Struggle To Protect Its Offshore Economy Bloomberg

Kyc For British Virgin Islands Shufti Pro

Bvi S Government Commits To Publicly Accessible Registers

Data Leak Exposes Bvi Investors Names Financial Times

Bvi Named In Fincen Files Leaks

The Bvi S Struggle To Protect Its Offshore Economy Bloomberg

![]()

Bvi Premier Says Territory Is Ready To Implement Publicly Accessible Registers To Blunt Money Laundering

Offshore Bvi Company 4 Reasons You Shouldn T Register In Bvi

The world of laws can seem like a bowl of alphabet soup at instances. US money laundering rules are not any exception. We have now compiled a listing of the top ten cash laundering acronyms and their definitions. TMP Threat is consulting firm focused on protecting monetary companies by reducing threat, fraud and losses. Now we have massive financial institution experience in operational and regulatory danger. We have a strong background in program management, regulatory and operational threat as well as Lean Six Sigma and Business Course of Outsourcing.

Thus money laundering brings many adversarial consequences to the group as a result of dangers it presents. It will increase the probability of major risks and the opportunity price of the financial institution and ultimately causes the bank to face losses.